Health Insurance Brokers for Small Businesses: Key Findings and Insights from the Latest Industry Report

- December 15, 2023

- 2 minutes

Given the critical role that small businesses play in stimulating economic growth and fostering innovation, it is particularly pertinent to delve into the underexplored terrain of health insurance brokers, specifically for these business ecosystems. The synthesis from a recent industry report discloses intriguing insights and key findings about the role, relevance, and ramifications of health insurance brokers for small businesses.

Health insurance brokers are essentially professional intermediaries who guide businesses in their pursuit of the most suitable health insurance plans. They function as a conduit between insurance companies and business owners, navigating the labyrinthine world of health insurance on behalf of the businesses.

Small businesses, often lacking the resources to hire a dedicated team for managing health insurance affairs, can particularly benefit from such services. The brokers’ expertise can provide them with an edge in negotiating prices, understanding regulations, and comparing different insurance offerings.

A recent industry report has highlighted several noteworthy trends and insights about health insurance brokers in the small business sector. These findings shed light on the increasing importance of these brokers, the challenges they face and the opportunities they present in the health insurance landscape.

One of the key findings from the report underscores the escalating demand for health insurance brokers among small businesses. This surge can be ascribed to the inherent complexity of health insurance policies, coupled with the ever-evolving legal regulations surrounding them. Faced with the daunting task of deciphering the intricacies of various plans, small businesses are increasingly turning to brokers for assistance.

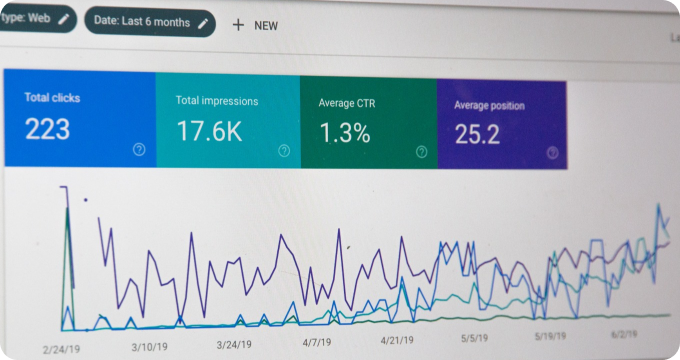

An interesting insight from the report is the intensified competition among brokers, largely fueled by the increasing demand for their services. This competitive landscape has precipitated some innovations in the realm of client engagement and customer experience. Brokers are now leveraging advanced digital tools and technologies for streamlining operations, improving customer service, and providing personalized offerings.

However, it is important to note that the use of technology in this field is a double-edged sword. While it has enabled superior customer experiences, it has also led to information overload and increased vulnerability to data breaches. This necessitates a delicate balance between technological adoption and data privacy regulations.

Another notable finding from the report pertains to the regulatory landscape governing health insurance brokers. The report suggests that the regulatory environment, particularly in the United States, is becoming increasingly stringent. This has resulted in an escalating need for brokers to stay abreast of the evolving regulations and alter their operations accordingly.

While the report sheds light on several important aspects of health insurance brokers for small businesses, a few potential areas of exploration remain. For instance, the role of brokers in facilitating access to alternative health insurance models such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) warrants further scrutiny. Additionally, the impact of socioeconomic factors on small businesses' reliance on brokers is a yet uncharted territory deserving investigation.

In conclusion, the complex terrain of health insurance necessitates the services of expert intermediaries, especially for small businesses. The latest industry report presents a comprehensive understanding of the role, challenges, and opportunities of health insurance brokers in this context. As small businesses continue to grapple with the intricacies of health insurance, brokers who can navigate this complexity, leverage technology effectively, and stay on top of regulatory changes, will find themselves at the helm of this burgeoning industry.

Learn More

Unearth the secrets to securing the best health insurance for your small business by delving deeper into our enlightening blog posts. For an unbiased, comprehensive view, the reader is encouraged to explore our meticulously compiled rankings of Top Health Insurance Brokers For Small Businesses.

Popular Posts

-

9 Reasons Why Small Businesses Need a Health Insurance Broker

9 Reasons Why Small Businesses Need a Health Insurance Broker

-

The Future of Health Insurance Brokers for Small Businesses: Predictions and Emerging Trends

The Future of Health Insurance Brokers for Small Businesses: Predictions and Emerging Trends

-

12 Things I Wish I'd Known About Health Insurance Brokers For Small Businesses Before Hiring One

12 Things I Wish I'd Known About Health Insurance Brokers For Small Businesses Before Hiring One

-

How to Hire the Right Health Insurance Broker for Your Small Business

How to Hire the Right Health Insurance Broker for Your Small Business

-

Ask These Questions to a Health Insurance Broker to Choose the Right One for Your Small Business

Ask These Questions to a Health Insurance Broker to Choose the Right One for Your Small Business